As Commercial Auto Insurance in Texas: Cheapest Rates for Delivery, Trades & Service Vehicles takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

When it comes to understanding the ins and outs of commercial auto insurance in Texas, businesses need to navigate through a myriad of factors to secure the best rates for their delivery, trades, and service vehicles. This article delves into the essentials of commercial auto insurance in the Lone Star State, shedding light on crucial aspects that every business owner should be aware of.

Overview of Commercial Auto Insurance in Texas

Commercial auto insurance in Texas is a type of insurance policy that provides coverage for vehicles used for business purposes. This includes vehicles used for delivery, trades, services, and any other business-related activities. It is essential for businesses in Texas to have commercial auto insurance to protect their vehicles, employees, and assets in case of accidents or other unforeseen events.

What Commercial Auto Insurance Covers

- Liability coverage for bodily injury and property damage

- Medical payments for injuries sustained by drivers and passengers

- Collision coverage for damage to the insured vehicle

- Comprehensive coverage for non-collision related incidents like theft or vandalism

Why Businesses in Texas Need Commercial Auto Insurance

- Legal requirements: Texas law mandates that all vehicles used for business purposes must have commercial auto insurance.

- Protection: Commercial auto insurance provides financial protection in case of accidents, lawsuits, or other liabilities.

- Asset protection: It helps protect business assets such as vehicles, equipment, and inventory.

Differences Between Commercial Auto Insurance and Personal Auto Insurance

- Usage: Personal auto insurance is designed for personal use vehicles, while commercial auto insurance is for vehicles used for business purposes.

- Coverage limits: Commercial auto insurance typically has higher coverage limits to account for the increased risks associated with business use.

- Premiums: Premiums for commercial auto insurance are usually higher than personal auto insurance due to the higher risks involved.

Examples of Businesses that Require Commercial Auto Insurance in Texas

- Delivery services such as courier companies and food delivery businesses

- Construction companies with work trucks and equipment vehicles

- Landscaping and lawn care businesses with service trucks and trailers

Types of Vehicles Covered

Commercial auto insurance in Texas typically covers a wide range of vehicles used for business purposes. Here are the different types of vehicles commonly covered under commercial auto insurance:

Delivery Vehicles Coverage in Texas

Delivery vehicles, such as vans or trucks used for transporting goods, are essential for businesses like courier services or food delivery. In Texas, commercial auto insurance provides coverage for delivery vehicles in case of accidents, theft, or damage. This coverage helps protect businesses from financial losses resulting from such incidents.

Trades Vehicles Coverage in Texas

Trades vehicles, including those used by contractors, plumbers, or other skilled professionals, are often covered under commercial auto insurance in Texas. This coverage extends to vehicles used for transporting equipment, tools, or materials to job sites. It helps protect tradespeople from liabilities and damages that may arise while on the job.

Service Vehicles Coverage in Texas

Service vehicles, such as those used by electricians, landscapers, or other service providers, are also included in commercial auto insurance coverage in Texas. This coverage ensures that vehicles used for providing services to customers are protected in case of accidents, property damage, or other unforeseen events.

It helps service-based businesses maintain operations smoothly and protect their assets.

Factors Affecting Rates

When it comes to commercial auto insurance rates in Texas, several key factors come into play that can impact how much you pay for coverage. Understanding these factors can help you make informed decisions when selecting an insurance policy for your business vehicles

Vehicle Type Impact

The type of vehicle you use for your business can have a significant impact on your insurance rates. Generally, larger and more expensive vehicles, such as delivery trucks or service vans, may come with higher insurance premiums due to the potential for more severe damages in case of an accident.

Driving History Influence

Your driving history, both as an individual and as a business, can also influence your insurance premiums. If you or your employees have a history of accidents or traffic violations, insurers may consider your business a higher risk and charge higher rates to compensate for that risk.

Location in Texas

The location of your business in Texas can also affect your insurance costs. Urban areas with higher traffic congestion and crime rates may result in higher insurance premiums compared to rural areas with less traffic and lower crime rates. Additionally, areas prone to severe weather conditions or natural disasters may also see higher insurance rates to cover potential damages.

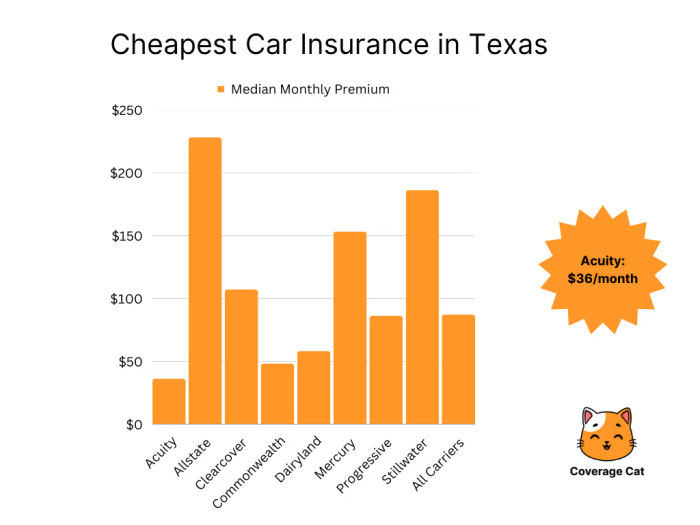

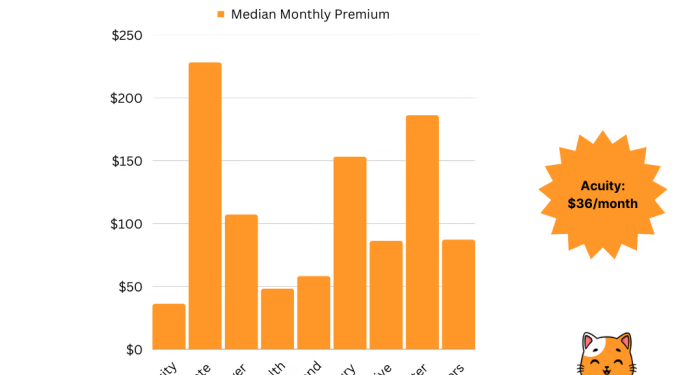

Finding the Cheapest Rates

When it comes to finding the cheapest commercial auto insurance rates in Texas, businesses need to be strategic in their approach. By comparing different insurance providers and customizing coverage, businesses can secure the best rates without sacrificing adequate protection.

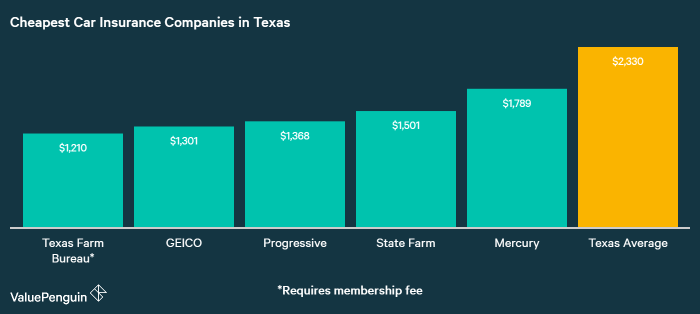

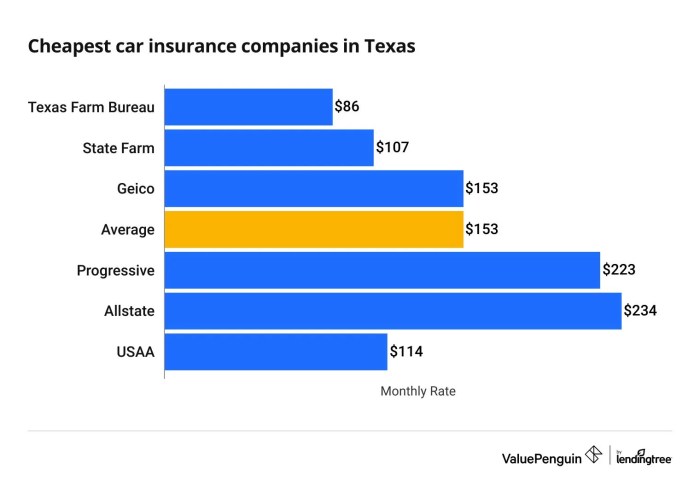

Comparing Insurance Providers

One of the most effective ways to find the cheapest rates for commercial auto insurance in Texas is to compare offerings from different insurance providers. Look for companies that specialize in coverage for delivery, trades, and service vehicles, as they may offer competitive rates tailored to your specific needs.

- Obtain quotes from multiple providers to compare premiums, coverage limits, and deductibles.

- Consider the reputation and financial stability of the insurance companies to ensure they can meet their obligations in case of a claim.

- Look for discounts or special programs that could lower your overall insurance costs.

Customizing Coverage for Best Rates

Customizing your coverage can also help you secure the best rates for commercial auto insurance in Texas. By tailoring your policy to the unique risks and requirements of your business, you can avoid paying for unnecessary coverage and reduce your premiums.

- Choose coverage limits that adequately protect your assets without over-insuring.

- Select deductibles that align with your risk tolerance and budget constraints.

- Add specific endorsements or riders to address any gaps in coverage that are relevant to your business operations.

Strategies to Reduce Insurance Costs

There are several strategies that businesses can implement to reduce insurance costs without compromising coverage for their commercial vehicles in Texas.

- Maintain a clean driving record and encourage safe driving practices among your employees to qualify for lower premiums.

- Invest in safety and security measures for your vehicles, such as GPS tracking systems, alarms, or immobilizers, to mitigate risks and potentially lower insurance rates.

- Consider bundling your commercial auto insurance with other business policies to qualify for multi-policy discounts.

Last Word

In wrapping up our discussion on Commercial Auto Insurance in Texas: Cheapest Rates for Delivery, Trades & Service Vehicles, it becomes evident that a comprehensive understanding of the coverage options, factors affecting rates, and strategies to find affordable insurance is vital for businesses operating in the state.

By prioritizing the right coverage tailored to their needs, businesses can safeguard their vehicles and financial assets, ensuring smooth operations and peace of mind.

Query Resolution

What does commercial auto insurance cover?

Commercial auto insurance typically covers liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage for vehicles used for business purposes.

Why do businesses in Texas need commercial auto insurance?

Businesses in Texas need commercial auto insurance to protect their vehicles, employees, and finances in case of accidents, theft, or other unforeseen events while using vehicles for business purposes.

How does driving history influence insurance premiums?

A clean driving record usually leads to lower insurance premiums, while a history of accidents or traffic violations can result in higher rates due to the perceived higher risk to insurers.

How can businesses find the cheapest commercial auto insurance rates in Texas?

Businesses can find the cheapest rates by comparing quotes from multiple insurance providers, leveraging discounts, adjusting coverage limits, and maintaining a good driving record.

![biBerk Insurance Review [2023] | Is It A Legit Buy Or Pass?](https://airconditioner.lokersemarang.co.id/wp-content/uploads/2025/12/insurancebee-home-1024x543-1-120x86.png)